Exemptions

Where a small employer or his employee can satisfy the council that any provisions of the agreement are restricting entrepreneurial initiative and/or employment opportunities, such an employer or employee may apply to the Council for exemption from the specific provisions and the Council may grant such an exemption. See clause 29.

An employee on probation earns ten percent (10%) less than the prescribed wage for a period not exceeding three (3) months. The wages prescribed pertain to the payment for ordinary hours of work as prescribed in clause 9. Should statutory legislation reduce these ordinary hours of work the wages will automatically be reduced proportionately, bearing in mind the overtime aspect.

| (1) |

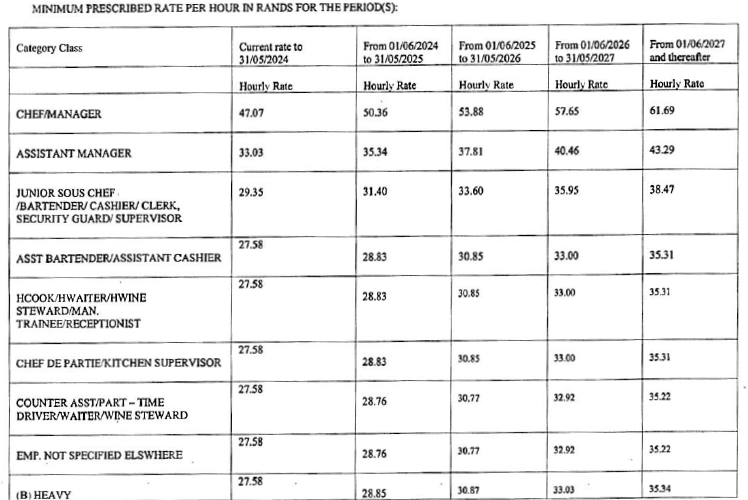

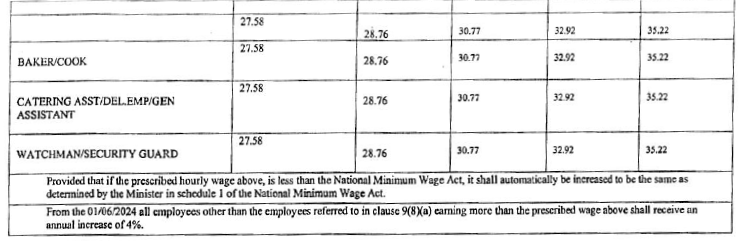

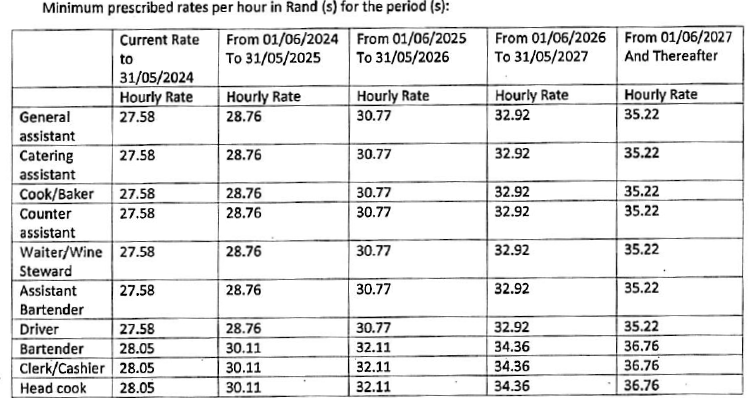

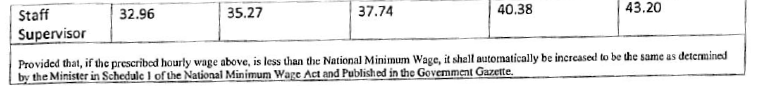

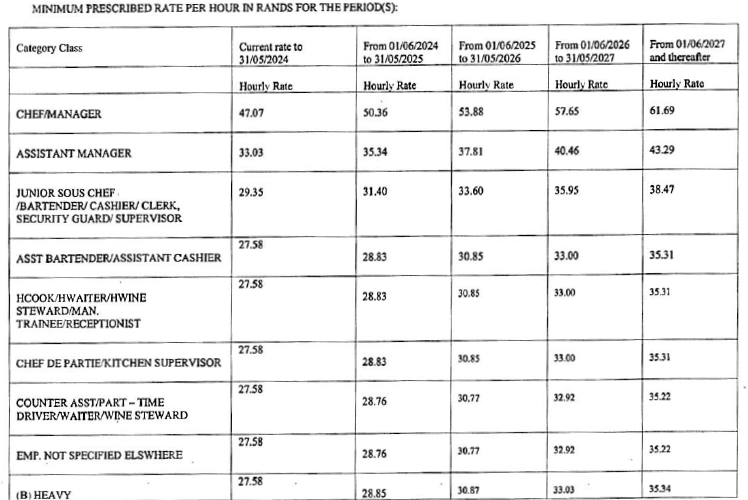

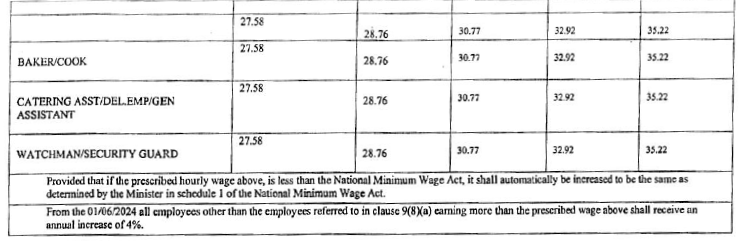

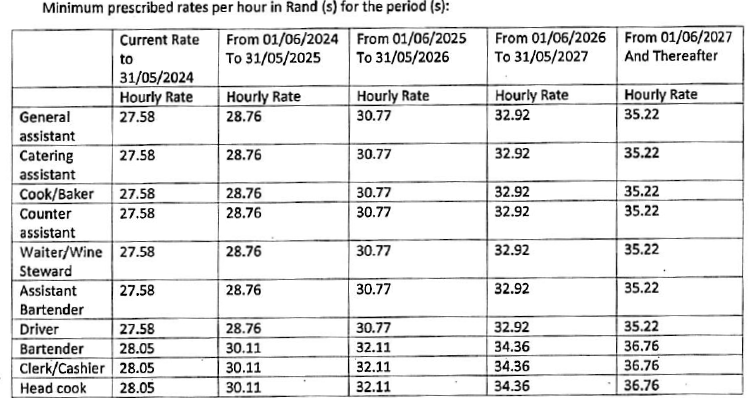

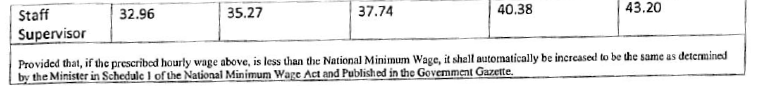

Subject to the provisions of sub-clause (3) of this clause and clause 6(9), the minimum wage which shall be paid in respect of the ordinary hours of work prescribed in clause 9 by an employer to each member of the undermentioned classes of employees shall be set out hereunder, and no employer shall pay, and no employee shall accept wages lower than the following for the undermentioned groups. Provided that, if the prescribed hourly wage paid to an employee for ordinary hours worked is less than the national minimum wage it shall be adjusted to be the same as determined by the Minister in Schedule 1 of the National Minimum Wage Act and published in the Government Gazette. Provided further that the wages so prescribed may be reduced by not more than 10 percent by a new employer and by a small employer as defined in clause 4. |

| (a) |

Employees, other than part time,casual,special function and commission worker(s) employed inthe Bargaining Council's registered scope and sector of the Restaurant, Catering and Allied Trades as set out in Annexure "A" attached to this agreement. |

| Note: (i) |

The equivalent monthly or weekly total due, amounts to multiplying the hourly rate by the employee's ordinary hours of work as prescribed in clause 5(1), read with 5(2) and 5(3), Basis of Contract. |

| (ii) |

Deductions for food - clause 17(1)(a) - amount to R70.00 per month or R16.15 per week. See clause 17(1)(b). |

A Part-time employee shall be paid in respect of the ordinary hours of work prescribed in clause 9 not less than the wage prescribed in paragraph (a) hereof for an employee of the same class as the one in which he is employed.

| 1. |

The owner/management of an establishment and a commission worker may agree in writing that the commission worker will perform the duties of a waiter if and when so required by the owner on which commission will be paid at the end of each shift/week/month. |

| 2. |

The owner/management shall pay a commission worker the rates applicable for commission work as agreed: Provided that if during any calculation period, the commission worker does not earn an amount equivalent to at least the prescribed minimum wage for waiters, excluding any gratuity or tips, the owner shall pay the commission worker not less than the applicable minimum wage as prescribed for waiters for the hours that the commission worker worked plus any gratuity, tips, or gifts. It is agreed that a 5% deduction fee is applicable in respect of credit card tips, gratuities or gifts for administration and bank charges. |

| 3. |

Commission workers to receive a funeral benefit, with both parties contributing in equal portions to the monthly contribution in the amount of R12-50 each as per clause 21(8) of this agreement. This benefit will apply to non-parties as promulgated by the Minister. |

| 4. |

Commission workers working a minimum of 130 hours per month and for a minimum period of 2 years and longer with the same employer, shall be eligible to join the Provident Fund as per clause 21(C) of this agreement. |

| 5. |

An agreement to perform commission work In terms of this clause shall be concluded before the work commences and shall include— |

| (a) |

the commission worker's rate of commission; |

| (b) |

the basis for calculating commission; |

| (c) |

the period over which the payment is calculated, which period may not be longer than one month; |

| (d) |

when the employer shall pay the commission to the employee, which commission may not be paid more than seven days after the end of the period in which the commission was earned; and |

| (e) |

the type, description, number, quantity, margin, profit or orders (individual, weekly, monthly or otherwise) for which the employer is entitled to earn commission. |

| 6. |

The owner/management shall supply the commission worker with a copy of the agreement to perform commission work. |

| 7. |

The commission worker may apply for full time employment as a waiter, if a vacancy exists within the establishment for a waiter and the commission worker qualifies for the position of a waiter. |

| 8. |

An employer who intends to cancel or amend the agreement in operation shall give the commission workers not less than four weeks' notice of such intention. |

| (d) |

Casual employee other than a special-function casual employee |

A casual employee shall be paid not less than one and a half times the hourly wage prescribed in paragraph (a) hereof for an employee of the same class as the one in which he is employed: Provided that:

| (1) |

Where a casual employee performs the work of a class of employee for whom wages on a higher scale are prescribed, the expression "hourly wage" shall mean the highest wage prescribed for an employee of that class; and |

| (2) |

Where a casual employee is required to work for less than four hours on any day he shall be deemed to have worked for four hours. |

| (e) |

Special-function casual employees |

Where a special-function casual employee is required to work for less than five hours on any day he shall be deemed to have worked for five hours

| (2) |

Calculation of wages: |

The calculation of a wage of an employee is calculated by reference to an employee's ordinary hours of work, excluding any gratuities, tips or gifts. It is agreed that a 5% deduction fee is applicable in respect of credit card tips, gratuities or gifts.

| (a) |

The daily wage of an employee shall be calculated by dividing his weekly wage as follows: |

| (1) |

by six in the case of an employee who works on six days per week |

| (2) |

by five in the case of an employee who works on five days per week |

| (b) |

The weekly wage of a monthly paid employee shall be calculated by dividing the monthly wage by four and one-third |

| (c) |

The hourly wage of an employee shall be calculated by dividing the weekly wage by the number of the weekly ordinary hours that the employee worked. |

| (3) |

Basis of contract: for the purpose of this clause the contract of employment of an employee other than a casual employee, and a special - function casual employee, shall be on a weekly and, save as provided in clause 6(9), an employee shall be paid in respect of a week not less than 30 hours per week or 135 hours per month,provided that an employee agrees to work less than 45 hours per week. |

| (4) |

Differential wage: Any employer who requires or permits a member of one class of his employees to perform work of another grade for longer than one hour in the aggregate on any day, either in addition to his own work or in substitution therefore, for which a wage higher than for his own grade is prescribed in subclause (1), shall pay such employee in respect of such day not less than the daily wage calculated at the higher rate. |

| (5) |

Unless expressly otherwise provided in a written contract between an employer and his employee, nothing in this Agreement shall so be construed as to preclude an employer from requiring his employee to perform work of another grade, for which grade the same or lower wage is prescribed for such employee. |

| (6) |

Reduction of wages: An employer shall not reduce the wages of an employee who at the time this Agreement comes into operation or at any time thereafter, is paid a wage at a rate higher than the minimum rate prescribed for his grade in this Agreement, as long as he continues to work for the same employer. Provided that where a weekly-paid employee has been given one week's notice, or a monthly-paid employee two weeks' notice, of a change of conditions of employment and such employee agrees in writing to accept a transfer to a grade of work for which a lower minimum wage is prescribed, this provision shall not apply. |

| (7) |

Night Work: An employer who requires a full lime employee, other than a commission worker, a casual employee, a special function casual employee and employees referred to in clause 9(8) to perform night work, shall pay such an employee an amount of R1.00 per hour, as a shift allowance, in addition to the employee's salary for the hours worked between 18:00 and 06:00 or grant the employee at least 10 minutes time off on full pay, for every hour worked at the end of each week. |

| (8) |

An employer shall pay an employee other than part-time, casual, special function and commission workers the following as an annual bonus payable during December:— |

| (i) |

one weeks wages for one year completed service; |

| (ii) |

two weeks wages for two years completed service |

| (9) |

As from date of publication of this agreement an employer, other than a small employer shall pay an employee other than a part-time, casual, special-function and commission workers the following as an annual bonus, payable during December: |

| (i) |

Three weeks wages for three years of completed service; |

| (ii) |

Four weeks wages for four or more years completed service. |

| (10) |

Work on Sunday: An employer, shall pay an employee, who ordinarily works on a Sunday, at one and a half times the employee's wage for each hour worked. Provided that an employer may grant an employee who works on a Sunday, paid time off equivalent to the difference in value between the pay received by the employee for working on a Sunday and the pay that the employee is entitled to in terms of subclause (1). |

National Qualifications Framework Act, 2008

National Qualifications Framework Act, 2008