Wednesday 25 May is tax freedom day

The good news is that as of Wednesday 25th May, everything you earn is yours to keep. The bad news is that up until Wednesday, you have been working for the government - and you spent five more days as a slave to government than in 2015. Every year the Free Market Foundation meaures how many days it takes to discharge South Africans' "debt" to government - in other words, how many days you must work to pay off the government's share of GDP.

The good news is that as of Wednesday 25th May, everything you earn is yours to keep. The bad news is that up until Wednesday, you have been working for the government - and you spent five more days as a slave to government than in 2015. Every year the Free Market Foundation meaures how many days it takes to discharge South Africans' "debt" to government - in other words, how many days you must work to pay off the government's share of GDP. Wednesday, 25 May 2017, is Tax Freedom Day (TFD). Five days later than in 2015 and six weeks later than in 1994. This trend is likely to continue as government spending, the deficit and government debt continues to increase.

Tax Freedom Day is a measure of how much time you spend working for someone else’s benefit – government GDP – rather than your own. TFD is the day we, the people of South Africa, at last start to work for ourselves. It is the day on which we have finally paid our tax bill in full. From 1 January until 25 May, all the income earned by average South Africans make up the amount of money needed to pay for one year of government spending.

Judged by international standards, our government spending is very high – in the worst 17% of countries in the world for our level of development. Even worse, our government spending is growing at such an alarming pace that it is using our taxes more and more for consumption spending rather than for core functions and capital projects.

Taxes shift resources from the private sector to the public – government. Because SA’s future depends on private sector growth is why TFD is important. High taxation slows, not grows, an economy. Government is both less innovative and less efficient than the private sector.

On TFD, we have the opportunity to think about the role of government in our lives and whether we are getting value for money, the right service delivery and effective programmes.

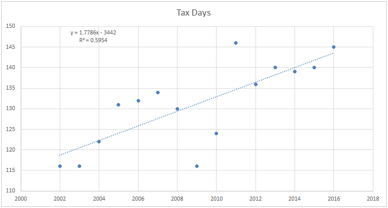

Statistician, Garth Zietsman, has calculated that average income earners will work five more days in 2017 than in 2015 before TFD. He said, “Given the estimated Central Government Revenues for 2017 as a percentage of GDP, Tax Freedom Day for 2017 is estimated to occur on May 25 – five days later than 2015. There has been a trend toward taking more of the GDP in taxes every year”.

South African citizens need to understand that the only way government can find the money to fund its spending is to increase the taxes we pay. All taxes gathered by government, whether on personal income, sales, property, corporate profits, international trade, or whatever, are eventually paid by citizens of a country.

The table below shows that TFD this year is 5 days later than last years and 6 weeks later than in 1994. Government is absorbing more resources than it did 23 years ago.

Year – Tax Freedom Day

1994 – 12 April

1995 – 16 April

1996 – 13 April

1997 – 16 April

1998 – 16 April

1999 – 20 April

2000 – 22 April

2001 – 20 April

2002 – 26 April

2003 – 26 April

2004 – 2 May

2005 – 11 May

2006 – 12 May

2007 – 14 May

2008 – 10 May

2009 – 26 April

2010 – 4 May

2011 – 26 May

2012 – 16 May

2013 – 20 May

2014 – 19 May

2015 – 20 May

2016 – 25 May

2017 – 25 May (5 days more than 2015; 6 weeks more than 1994)

As the graph shows, government is taking a steadily increasing percentage of people’s earnings, which means that we have to work longer every year for the government and have fewer days to work for ourselves.

Tax that government takes is spread over the year but it is useful to illustrate just how much it is by calculating what chunk of earnings it represents to see how many days of work in the year it takes to earn the amount of money we need to pay those taxes.

This is important because higher marginal tax rates reduce the incentives for entrepreneurs who are unwilling to risk their capital or sacrifice their time and energy to earn higher incomes. High tax rates interfere with the ability of individuals to pursue their goals because they result in less disposable income. Less disposable income means less saving; less saving means less capital formation; less capital formation means lower labour productivity; and lower labour productivity means lower real wages.