The Organisation Undoing Tax Abuse (Outa) has threatened legal action against SAA should it proceed with a R15 billion refinancing of the airline using a boutique finance house, BnP Capital, which has no track record in a deal of this size or nature, and in fact had its Financial Services Board licence revoked. The board of SAA chose BnP over more credible financial institutions, and agreed to pay three times what other bidders were offering - all in the name of "transformation". Then SAA fired Cynthia Stimpel, the group treasurer, for objecting to this outrageous deal.

Read More »

Eddie Cross, the Movement for Democratic Change MP in Zimbabwe, says the country is at a crisis point similar to that of 2008 when the government abandoned the Zimbabwe dollar after inflation peaked at 500 million percent. A quarter of the country's children are orphans and the military is running the ruling party. A free election is now the only route out, argues Cross.

Read More »

The Northern Irish courts are quietly setting international precedent when it comes to securitisation and "double dipping" by the banks. Notice in this report how Santander Bank "destroyed" documents relevant to a claim being brought by the bank (just as Absa claims thousands of its documents were "destroyed" in a fire in 2009 so as to avoid presenting the originals in court). But in the Northern Irish case, the home owner moved to commit the CEO of Santander Bank and his "corrupt" officials and lawyers to prison for submitting a false claim toi the court.

Read More »

Two stories that suggest things are fast approaching a head in Zimbabwe. One involves riots over the number of police roadblocks travellers have to navigate as they try to make a living. It seems social protest independent of political party alliances is taking over the country. The second story involves a young Zimbabwean who told his president "F..k you" and landed himself in court. He also seemingly threatened President Mugabe's kids should anything happen to him.

Read More »

In this article Armand Rinier looks at how banks and other lenders are engaging in reckless lending. The practice is so common, it would require a book to cover all the creative ways banks are breaking the law. It's time to pull out your bank statements and see whether or not you are being gouged by the banks.

Read More »

Carte Blanche recently exposed the routine violations of human rights by the banks, which have repossessed more than 100,000 homes in South Africa since 1994. These homes are then sold at a fraction of their worth at sheriffs' auctions. As the programme points out, the Constitutional Court has already ruled on this, requiring the banks to use auctions as a "last resort" and to find creative alternatives to the sale in execution.

Read More »

Dudu Myeni, the chair of SAA, cares little for the solvency of the national air carrier, nor does she seem to give a damn about corporate governance. The SAA in-flight magazine goes into the minutiae of race-based bean counting, and as such appears to be written for staff rather than SAA passengers. The airline has been dubbed "Hollywood" since it has "acting" rather than permanent postings for virtually all key appointments. SAA is one of the reasons SA's state-owned enterprises are dragging us to the brink of junk status.

Read More »

If every debtor served with a summons defended the action, it would choke the legal system and force the banks to come up with better solutions for customers who have difficulties in meeting their monthly payments. It's an actuarial fact that the average mortgage borrower will either default or settle the bond within seven years. Banks know this. Despite well-intentioned laws, lenders are engaging in reckless lending on a daily basis. In this regular weekly column, Debt Nurse Armand Rinier will explain how to effectively protect your rights and assets when under threat from the banks.

Read More »

In this article, Rex van Schalkwyk, a former Supreme Court judge, points out several instances where senior politicians and government officials stomped all over the Constitution, not to mention common law standards of fraud, and got away with it. Instead of being held to the same standard as the rest of us, they abusers were sheltered by their political bretheren.

Read More »

Michael Gray has brought out a documentary The Banker Suicides, questioning whether the dozens of banker "suicides" since 2007 were actually suicides, whether they were stress-related, or was there something more sinister afoot. In several of these suicides, there are common threads and connections that went previously undetected.

Read More »

A young Joburg couple ended up losing two houses after falling R17,500 in arrears on a copier machine they were renting. The Kromers knew nothing of the law when all this was going down, but now they are angry - and fighting back. Had they known at the time what they know now, they would have immediately defended the matter and leaned on the Constitutional prohibition on arbitrary deprivation of property. They would also have invoked the Conventional Penalties Act, which prevents a creditor making a claim such as this out of all proportion to the prejudice suffered.

Read More »

Lawyers are raking in fees from the blizzard of summonses issued by the SA National Roads Agency (Sanral) over the non-payment of e-tolls. The Organisation Undoing Tax Abuse (OUTA), which is fighting e-tolls, has its own legal team to defend the summonses, and has brought in one of the top legal minds in the country, Gilbert Marcus SC, to prepare for the court battle that lies ahead. This is likely to drag out for years, and could clog the court system.

Read More »

It's official. We are in an election and nearly 3m new voters have registered. Gareth van Onselen crunches the numbers, and suggests it doesn't look good for the ANC. It's unlikely it will win the 60% it claimed in the last election, but much depends on the energy of the opposition in these last few months before voting.

Read More »

A forensic scientist is planning to bring a class action suit against FNB over its systemic failure to represent its clients' interests on online banking fraud cases. The trigger for this was an attempt by FNB to reach a partial rather than a full settlement of a client's claim that R300,000 was stolen out of her account. FNB attempted to push at least some of the blame on the client.

Read More »

Where is South Africa's spirit of protest over outrageous bank behaviour in removing people from their homes? Greek activists have taken to protesting outside court houses and successfully blocked 800 home repossessions in the process. Perhaps South Africans will wake up from their slumber and start a similar movement here. Any takers?

Read More »

Judge Dolamo took just 45 seconds to dismiss a case brought by the Democratic Alliance calling for a commission of inquiry into the National Director of Public Prosecutions, Mongcobo Jiba, who has a long and storied history of going to bat for President Zuma in his own troubles with the law.

Read More »

What happened to Lisa Epstein in the US echoes the experience of thousands of South Africans faced with foreclosure - fuzzy legal language, missing documents and a simple strategy of bankruptiung their clients by dragging out legal arguments. Lisa studied up securitisation on her own, read the small print, and finally beat the bank. Here's what happened.

Read More »

Finance minister Pravin Gordhan's "imminent" arrest for allegedly setting up a rogue investigations unit in SA Revenue Services some years ago is a symptom of the disintegration within the government. The Hawks could better use their time chasing down the R25,7bn in irregular spending reported by the auditor general in 2014, and nearly R1bn more in fruitless and wasteful spending.

Read More »

As of this month, price fixing, market allocation and collusion could carry prison sentences of up to 10 years. Company managers and directors are now playing in a different league. The kind of collusive tendering we saw in the World Cup and Gauteng Freeway Project will in future likely result in criminal charges against the company bosses involved.

Read More »

The presidency was quick to squash rumours that finance minister Pravin Gordhan is about to be arrested for his alleged role in setting up a rogue investigations unit when he headed up SA Revenue Services. But the Hawks appear to have other plans. Zuma's recent behaviour suggests he is far from beaten. His mood was ebullient in recent days as visited Eskom's head office and declared power cuts a thing of the past. Then it was on to SAA to bestow his blessings there. Maybe Pravin will see out his term to 2019, but don't count on it.

Read More »

The latest figures show unemployment up at 26,7%, but the worst is yet to come. SA could lose a further 400,000 jobs next year according to one estimate, as reported in Moneyweb. This spells trouble for the ruling party heading into the local elections later this year, and the opposition will make sport of these figures to boost their electoral chances.

Read More »

The Free Market Foundation's challenge to labour unions was heard recently in the High Court, with both sides hailing it as a victory. It's clear the Foundation has grounds to celebrate as the judge's findings will make it more difficult for the minister of labour to extend so-called Bargaining Council Agreements (BCA) to employers who fall outside the BCA system. The Foundation says this is a victory for the millions of South Africans unemployed, and for marginalised workers.

Read More »

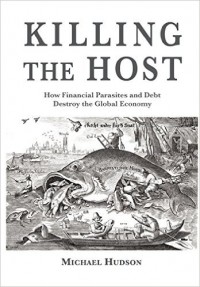

Economist Michael Hudson recently had plenty to say about the Panama Papers. He has a new book out called

Killing the Host which explains how US banks set up branches in Panama and Liberia - where income tax rates are zero - as a way to attract criminal drug money to the US rather than Switzerland. And how international corporations can book their earnings in Panama at zero tax, meanwhile the cash is safely stowed in a New York bank. Paul Craig Roberts looks at how Michael Hudson has deciphered the world of international finance, revealing a thinly disguised ruse of global proportions aimed at enriching the 1% at the expense of the 99%.

Read More »

Capitec is accused of making unjustified revenues of more than R1bn through its so-called multi-loan products. The accuser is Summit Financial Partners, which advises low income consumers with financial advice. The multi-loan products being sold by Capitec are claimed to generate margins of between 150% and 500%, according to Business Day.

Read More »

The Organisation Undoing Tax Abuse (Outa) has threatened legal action against SAA should it proceed with a R15 billion refinancing of the airline using a boutique finance house, BnP Capital, which has no track record in a deal of this size or nature, and in fact had its Financial Services Board licence revoked. The board of SAA chose BnP over more credible financial institutions, and agreed to pay three times what other bidders were offering - all in the name of "transformation". Then SAA fired Cynthia Stimpel, the group treasurer, for objecting to this outrageous deal.

The Organisation Undoing Tax Abuse (Outa) has threatened legal action against SAA should it proceed with a R15 billion refinancing of the airline using a boutique finance house, BnP Capital, which has no track record in a deal of this size or nature, and in fact had its Financial Services Board licence revoked. The board of SAA chose BnP over more credible financial institutions, and agreed to pay three times what other bidders were offering - all in the name of "transformation". Then SAA fired Cynthia Stimpel, the group treasurer, for objecting to this outrageous deal.