(1) For the purposes of this section—

"sales tax" means the sales tax levied under the Sales Tax Act;

"Sales Tax Act" means the Sales Tax Act, 1978 (Act No. 103 of 1978), as in force immediately prior to its repeal by this Act.

| (a) |

Where in the course of an enterprise carried on by a person registered as a vendor in terms of the Sales Tax Act that person has before the commencement date entered into an agreement for the sale of movable goods and sales tax would have been payable by him in respect of the taxable value of such sale if the said Act had not been repealed but the said tax is not payable by reason of the fact that the consideration payable by the purchaser in respect of such sale has not been paid in full before the commencement date and delivery of the said goods has not been effected before that date, the said person shall, if on the commencement date he is a vendor as defined in section 1 of this Act, be deemed for the purposes of this Act to have supplied the said goods at the time of delivery of the said goods or the time at which any payment in respect of the said consideration is made on or after the commencement date or the time at which an invoice in respect of such sale is issued on or after that date, whichever time is earliest. |

| (b) |

Where any leased property has been leased by a vendor under the Sales Tax Act who is on the commencement date a vendor under this Act, to a lessee under a financial lease, as defined in section 1 of the Sales Tax Act, and such property is delivered to the lessee on or after that date, such property shall, notwithstanding the provisions of section 9 of this Act, be deemed for the purposes of this Act to have been supplied to the lessee under an instalment credit agreement at the time of delivery of such property. |

| (3) |

Where, on or after the commencement date, any amount accrues to a vendor who was a vendor for the purposes of the Sales Tax Act and the amount so accruing, or a portion thereof, would, but for the repeal of that Act, have been taken into account in the determination of a taxable value chargeable with sales tax— |

| (a) |

in terms of section 5(1)(c) of that Act in respect of a rental consideration for a period which ended before the said date; or |

| (b) |

in terms of section 5(1)(d) of that Act in respect of a taxable service completed before that date; or |

| (c) |

in terms of section 5(1)(e) of that Act in respect of board and lodging supplied for a period which ended before that date; or |

| (d) |

in terms of section 5(1)(f) of that Act in respect of accommodation let for a period which ended before that date, |

value-added tax shall, notwithstanding anything in this Act to the contrary, be chargeable under this Act in respect of that amount as though such amount were consideration for a supply of goods or services supplied by the vendor on the date on which that amount accrued.

| (3A) |

This Act shall not be construed as imposing value-added tax under section 7(1)(a) in respect of— |

| (a) |

a provision of goods under a rental agreement entered into before the commencement date for a period which ended before that date where such goods did not constitute goods as defined in section 1 of the Sales Tax Act; or |

| (b) |

a performance of services under an agreement entered into before that date where the performance of such services is completed before that date or such services were performed during and in respect of a period which ended before that date, if in either case such services were not taxable services as contemplated in the definition of "taxable service" in section 1 of the Sales Tax Act. |

| (4) |

Where the value of any supply of goods or services, as determined under section 10, includes any amount which has been taken into account by a vendor in the determination of a taxable value under the Sales Tax Act, and sales tax was chargeable in respect of such taxable value under section 5 of that Act or would have been so chargeable but for the provisions of section 6 of that Act, the value in respect of such supply shall for the purposes of the value-added tax be reduced by the said amount (but excluding so much of that amount as represents sales tax). |

| (5) |

For the purposes of this Act, where— |

| (a) |

goods are provided under a rental agreement for a period which commences before and ends on or after the commencement date; or |

| (b) |

the performance of any services is commenced before and is completed on or after that date; or |

the value of the supply, as determined under this Act, shall not be reduced to take account of any portion thereof made before the said date: Provided that-

| (i) |

where the goods referred to in paragraph (a) consist of fixed property , there shall be excluded from the rental consideration of the supply so much of such consideration as is attributable to the portion of the period referred to in that paragraph which ends before the said date; |

| (ii) |

where the services referred to in paragraph (b) were not taxable services for the purposes of the Sales Tax Act— |

| (aa) |

any progress payment in respect of that portion of the services performed before the said date shall for the purposes of this Act be ignored; and |

| (bb) |

where any payment becomes due or is received in respect of services which were not taxable services for the purposes of the Sales Tax Act and which are commenced before and completed on or after the said date, that portion of the payment which, on the basis of a fair and reasonable apportionment, is attributable to the portion of the services performed before the said date shall be excluded from the consideration for the supply. |

| (6) |

Where any payment is made or an invoice is issued on or after the date of promulgation of this Act and before the commencement date in respect of consideration for the supply of any goods or services (not being a transaction in respect of which a taxable value is subject to sales tax), a supply of such goods or services shall be deemed to have been made on the commencement date to the extent to which such payment or invoice relates to the provision of goods or the performance of services on or after the commencement date: Provided that this subsection shall not apply in respect of any payments customarily made or invoices customarily issued, when made or issued at regular intervals for the provision of goods or performance of services still to be provided or performed. |

| (a) |

In the case of a vendor who was on the day before the commencement date a vendor for the purposes of the Sales Tax Act an adjustment shall be made in the manner provided in paragraphs (c) and (d) in respect of sales tax attributable to any amount which would, but for the repeal of that Act, have been accounted for under paragraph (d), (i), (iv) or (vi) of subsection (2) of section 11 of that Act. |

| (b) |

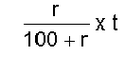

The sales tax attributable to such amount shall be determined by applying the formula |

in which formula "r" is the rate of sales tax, expressed as a percentage, which was in force on the day before the commencement date and "t" is the said amount.

| (c) |

The adjustment shall be made in the tax period of the vendor under this Act which, as nearly as possible, corresponds with the tax period of the vendor which would. but for the repeal of the Sales Tax Act, have applied under that Act. |

| (d) |

The adjustment shall be made by including in the amounts of output tax accounted for under section 16(3) of this Act in respect of the relevant tax period under this Act the amount of sales tax attributable to the amount that would have been accounted for under paragraph (d) of subsection (2) of section 11 of the Sales Tax Act and by including in the amounts of input tax accounted for under the said section 16(3) such amount as would have been accounted for under paragraph (i), (iv) or (vi) of the said subsection (2). |

| (8) |

Where, in the case of a vendor who was for the purposes of the Sales Tax Act a liquor trader as defined in paragraph 1 of the Schedule to Government Notice No. 339 published in Government Gazette No. 10615 on 20 February 1987, an amount of an excess referred to in paragraph 4(2) of that Schedule could, but for the repeal of the Sales Tax Act, have been carried forward from the tax period under that Act ending on the day before the commencement date, that amount shall, if on that date he continued to carry on the trade of selling liquor, for the purposes of section 16(3) of this Act be deemed to be input tax paid by him in respect of a supply of liquor made to him on that date. |

| (a) |

Notwithstanding the provisions of subsection (6), where fixed property has been disposed of under an agreement for the sale of such property concluded before the commencement date, the disposal of such property under such sale shall be deemed not to be a supply of goods for the purposes of this Act: Provided that where an agreement for the construction of improvements on such property has been concluded before the said date and the consideration payable under such agreement is in terms of section 6(1)(c) of the Transfer Duty Act, 1949 (Act No. 40 of 1949), required for the purpose of the payment of transfer duty to be added to the consideration payable in respect of the acquisition of such property, such agreement and the agreement for the sale of the property shall for the purposes of this paragraph be deemed to be one agreement for the sale of the property. |

| (aA) |

Where an agreement for the sale of fixed property consisting of any dwelling together with land on which it is erected, or of any real right conferring a right of occupation of a dwelling or of any unit as defined in section 1 of the Sectional Titles Act, 1986 (Act No. 95 of 1986), such unit being a dwelling, or of any share in a share block company which confers a right to or an interest in the use of a dwelling, was concluded on or before 31 March 1992 by a vendor who at the time of such sale holds such fixed property as trading stock, such sale shall, if the dwelling concerned was completed within 12 months before the commencement date, be deemed not to be a supply of goods for the purposes of this Act. |

| (aB) |

Where an agreement (other than an agreement referred to in paragraph (aC) for the sale of fixed property consisting of land, or of any real right conferring a right of occupation of land, was concluded on or after the commencement date and on or before 31 March 1992 for the sole or principal purpose of the erection by or for the purchaser of a dwelling or dwellings on the land, as confirmed by the purchaser in writing, the tax chargeable under section 7(1)(a) in respect of the supply of the land or real right under such sale shall be reduced to an amount equal to 6 per cent of the value of the supply. |

| (aC) |

Where fixed property includes a dwelling, and— |

| (i) |

the erection of the dwelling was completed on or after 30 September 1991 and on or before 31 December 1991 and an agreement for the sale of such fixed property was concluded on or after 22 August 1991 and on or before 31 December 1991, the tax chargeable under section 7(1)(a) in respect of the supply of the fixed property under such sale shall be reduced to an amount equal to 3 per cent of the value of the supply; or |

| (ii) |

the erection of the dwelling was completed on or after 30 September 1991 and on or before 31 March 1992 and an agreement for the sale of such fixed property was concluded on or after 22 August 1991 and on or before 31 March 1992, the tax chargeable under section 7(1)(a) in respect of the supply of the fixed property under such sale shall, subject to the provisions of subparagraph (i), be reduced to an amount equal to 6 per cent of the value of the supply: |

Provided that—

| (i) |

where an agreement has been concluded for the erection of a dwelling on land supplied under a sale and the consideration payable under such agreement would in terms of section 6(1)(c) of the Transfer Duty Act, 1949, if that Act were applicable, be required for the purpose of the payment of transfer duty to be added to the consideration payable in respect of the acquisition of the property, such agreement and the sale shall, subject to the provisions of paragraph (ii) of this proviso, for the purposes of this paragraph be deemed to be one agreement for the sale of the property; |

| (ii) |

the tax payable in respect of the supply of the land and the supply of the construction services in respect of the erection of a dwelling as contemplated in paragraph (i), shall be separately payable in respect of each supply in accordance with the provisions of this Act; |

| (iii) |

where the agreement for the sale of such fixed property was concluded before the commencement date, the provisions of paragraph (a) of this subsection shall apply unless the seller and the purchaser under the sale agree in writing that that paragraph shall not apply and that this paragraph shall apply. |

| (aD) |

Where any agreement (other than an agreement referred to in paragraph (i) of the proviso to paragraph (aC)) for the construction by any vendor carrying on a construction enterprise of any new dwelling was concluded on or before 31 March 1992 and the dwelling was to be erected in the course of such enterprise, the tax chargeable under section 7(1)(a) in respect of the supply of the construction service, including any construction service supplied to the vendor by a subcontractor, shall to the extent that such services were performed on or before 31 March 1992 be reduced to 6 per cent of the value of the supply. |

| (b) |

For the purposes of this subsection where an option to purchase fixed property or a right of pre-emption in respect of Fixed property is granted, the agreement for the sale of the property shall be deemed to be concluded when the option or right of pre-emption is exercised. |

| (10) |

Where any vendor who is on or with effect from the commencement date registered under section 23 and on that date— |

| (a) |

carries on a construction, civil engineering or similar enterprise and has on hand a stock of materials acquired by him prior to that date in order to be used by him for the purpose of incorporation in any building or other structure or work of a permanent nature to be erected, constructed, assembled, installed, extended or embellished by him in the course of such enterprise, and sales tax has been borne by him in respect of such materials; or |

| (b) |

has on hand a stock of consumable goods or maintenance spares acquired under sales concluded by him or the importation by him prior to that date for the purpose of consumption or use in the course of his enterprise, and sales tax has been borne by him in respect of such sales or importation. |

and on or after that date any item of such stock is withdrawn by him for the purpose referred to in paragraph (a) or the purpose referred to in paragraph (b), as the case may be, the vendor may, provided he has taken stock of such materials, consumable goods or maintenance spares, as the case may be, and he retains properly prepared stock lists in respect of such stocktaking, include in the amounts of input tax deducted by him under section 16(3) in respect of the tax period during which such item is withdrawn, the amount of sales tax borne by him in respect of that item: Provided that where the vendor does not maintain records which are adequate enough to determine when items are withdrawn from such stocks or the sales tax so borne thereon in respect of sales to him of such items, the Commissioner may, on application by the vendor, authorise him to deduct the actual sales tax borne by him in respect of such sales or an amount of sales tax which on the basis of a reasonable calculation represents the amount of sales tax so borne by him on the stocks in equal instalments by way of inclusions in the input tax deducted by the vendor in his tax returns over a period of two years or such shorter period as the Commissioner may allow.

| (10A) |

Where sales tax has been borne by any vendor (being a person who is on or with effect from the commencement date registered under section 23) in respect of the acquisition of goods (other than fixed property or goods incorporated therein) under a sale or the importation of goods and such goods are held by him on the commencement date as trading stock as defined in section 1 of the Income Tax Act, whether or not the vendor is liable for normal tax under that Act, the vendor may, provided he has taken stock of such goods and he retains properly prepared stock lists in respect of such stocktaking, include the amount of that tax in the amount of input tax deducted by him under section 16(3) in respect of the tax period during which such goods are supplied by him in the course or furtherance of his enterprise: Provided that where it appears to the Commissioner that the keeping of records for the purposes of the preceding provisions of this subsection can be dispensed with without prejudice to revenue collections, the Commissioner may, on application by the vendor, authorise him to deduct the sales tax on stocks of such goods so held by the vendor in equal instalments by way of inclusions in the input tax deducted by the vendor in his tax returns over a period of two years or such shorter period as the Commissioner may allow. |

| (i) |

is on the day before the commencement date registered as a vendor under the Sales Tax Act; |

| (ii) |

at the end of that day has in his possession goods (as defined in that Act) which he has not disposed of or which he has disposed of under a sale but for which he has not received full payment and in either case sales tax was not borne by him on acquisition; and |

| (iii) |

on the commencement date is not a vendor for the purposes of this Act, |

he shall for the purposes of the Sales Tax Act be deemed to have applied such goods on the day referred to in subparagraph (i) to a use or consumption contemplated in section 5(1)(h) of that Act.

| (b) |

Any sales tax payable under the Sales Tax Act in respect of the taxable value of such goods shall be payable at the rate of 10 percent and may be paid to the Commissioner within the period of three months reckoned from the day after the commencement date, without penalty. |

Sterilisation Act, 1998

Sterilisation Act, 1998

![]()