Sterilisation Act, 1998

Sterilisation Act, 1998

R 385

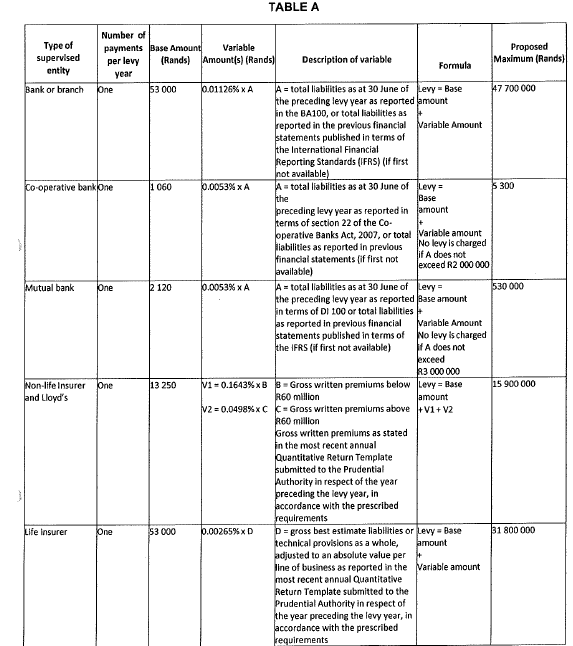

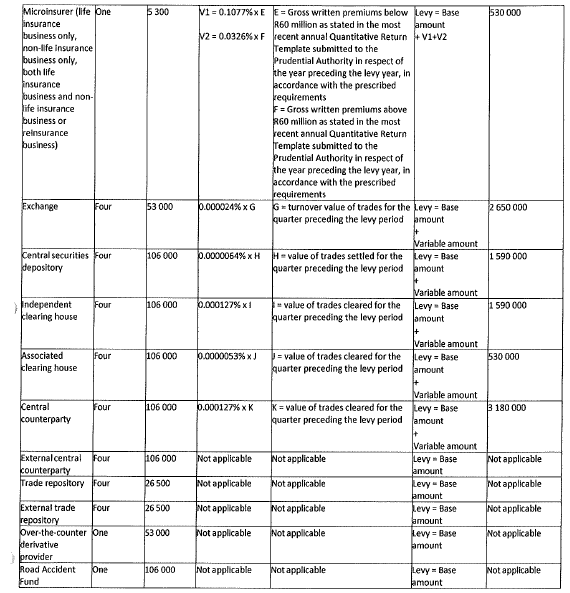

Financial Sector and Deposit Insurance Levies Act, 2022 (Act No. 11 of 2022)SchedulesSchedule 1 : Financial Sector Levy Calculation for Supervised Entities in respect of Prudential Authority (Section 4(1)(b)) |

SCHEDULE 1

FINANCIAL SECTOR LEVY CALCULATION FOR SUPERVISED ENTITIES IN RESPECT OF PRUDENTIAL AUTHORITY

(Section 4(1)(b))

Application

| 1. | Table A must be applied to calculate the levy payable by a supervised entity that is— |

| (a) | a bank or a branch; |

| (b) | a co-operative bank; |

| (c) | a mutual bank; |

| (d) | a non-life insurer; |

| (e) | a life insurer; |

| (f) | Lloyd’s; |

| (g) | a micro-insurer; |

| (h) | an exchange; |

| (i) | a central securities depository; |

| (j) | an independent clearing house; |

| (k) | an associated clearing house; |

| (l) | a central counterparty; |

| (m) | an external central counterparty; |

| (n) | a trade repository; |

| (o) | an external trade repository; |

| (p) | an over-the-counter derivative provider; or |

| (q) | the Road Accident Fund. |

Alleviation of double levy payment in respect of clearing house

| 2. | A clearing house that is approved in terms of section 110(6) of the Financial Markets Act to perform the functions of a central counterparty or a licensed independent clearing house who is also licensed as a central counterparty is liable to pay the levy applicable to a central counterparty, but is not liable to pay the levy applicable to an associated clearing house or an independent clearing house. |

Levy payment in respect of reinsurer

| 3. | A reinsurer that is licensed under the Insurance Act for— |

| (a) | non-life insurance business only, must pay the levy as if that reinsurer was a non-life insurer; |

| (b) | life insurance business, must pay the levy as if that reinsurer was a life insurer; or |

| (c) | both life insurance business and non-life insurance business, must pay the levy separately for the life insurance business and non-life insurance business. |

[Table A of Schedule 1 substituted by Notice No. 5613, GG51705, dated 4 December 2024]