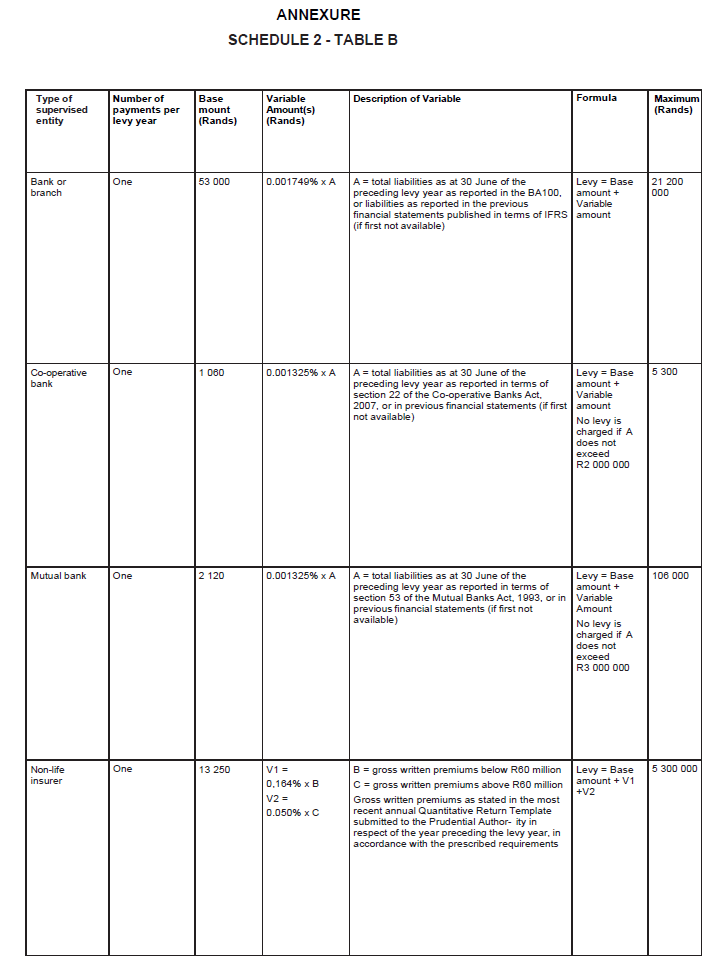

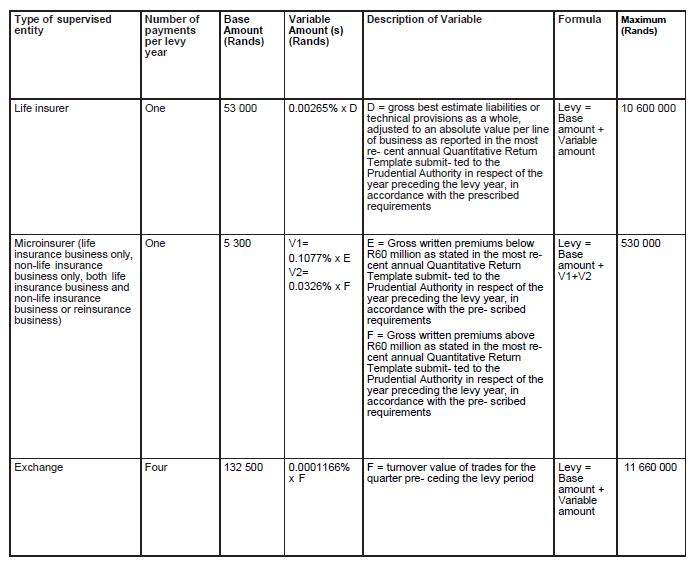

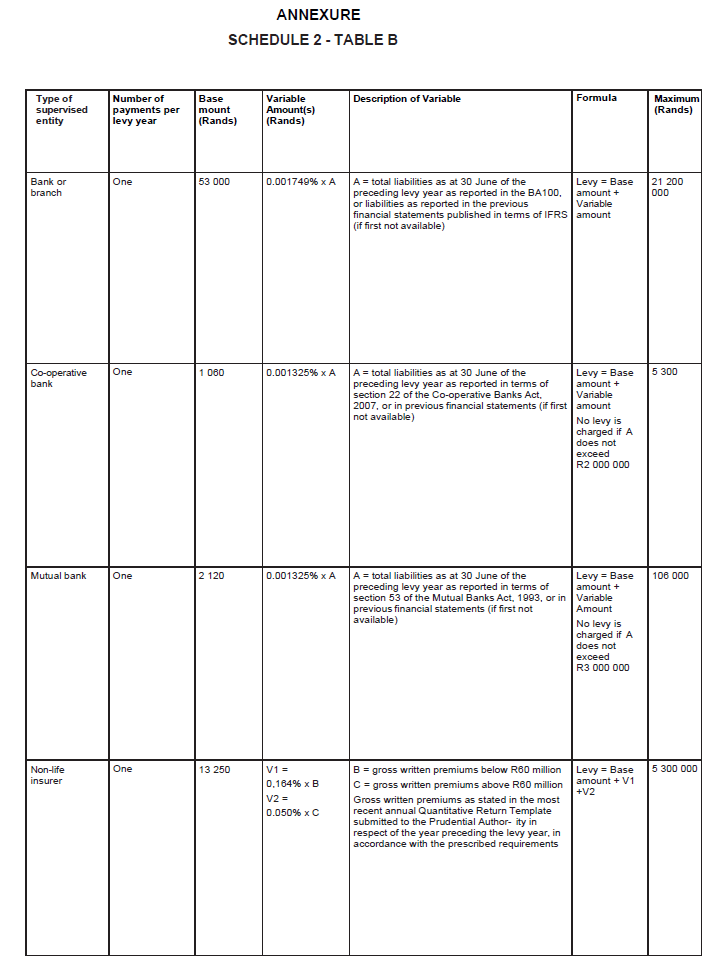

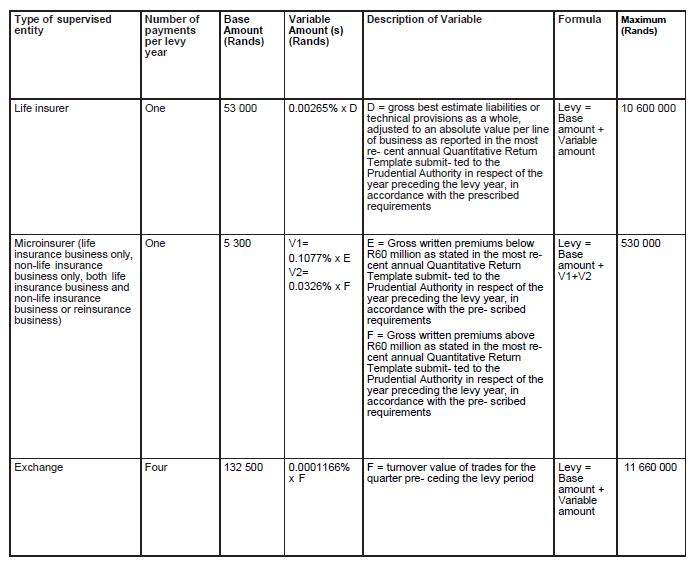

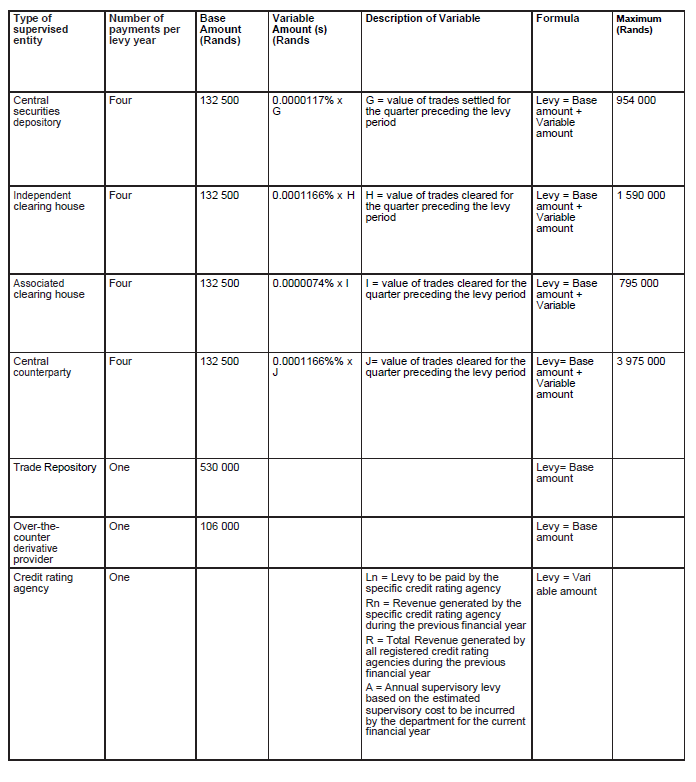

SCHEDULE 2

FINANCIAL SECTOR LEVY CALCULATION FOR SUPERVISED ENTITIES IN RESPECT OF FINANCIAL SECTOR CONDUCT AUTHORITY

(Section 4(1)(a))

Application

| 1. |

Table B must be applied to calculate the levy payable by a supervised entity that is— |

| (f) |

a micro-insurer that conducts life insurance business only, non-life insurance business only, both life insurance business and non-life insurance business or reinsurance business; |

| (h) |

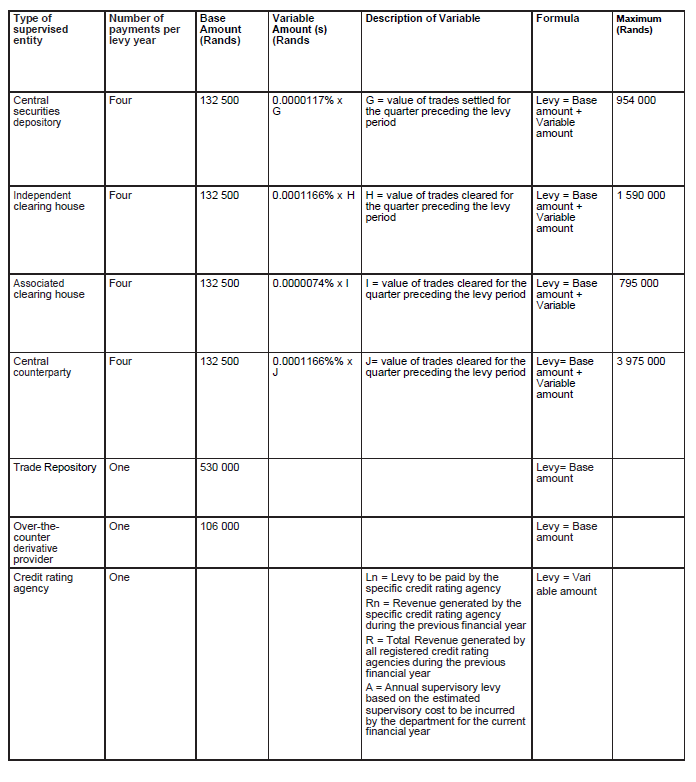

a central securities depository; |

| (i) |

an independent clearing house; |

| (j) |

an associated clearing house; |

| (k) |

a central counterparty; |

| (m) |

an over-the-counter derivative provider; or |

| (n) |

a credit rating agency; |

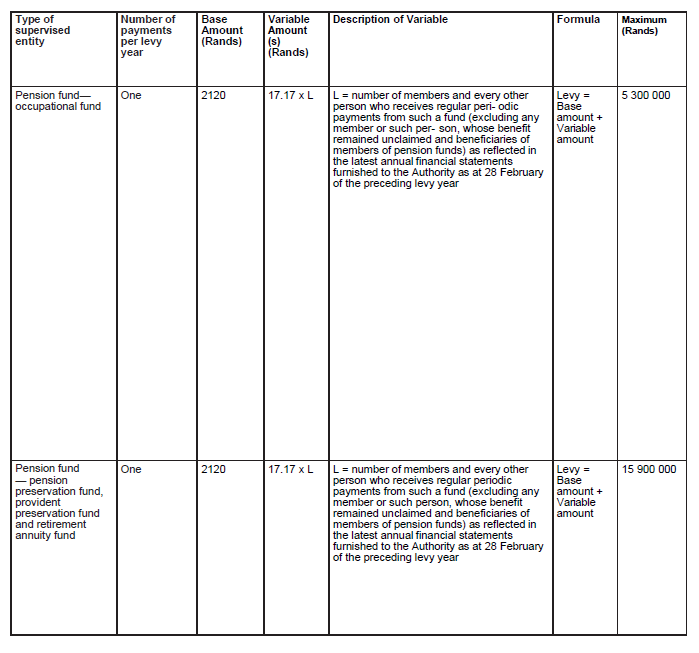

| (o) |

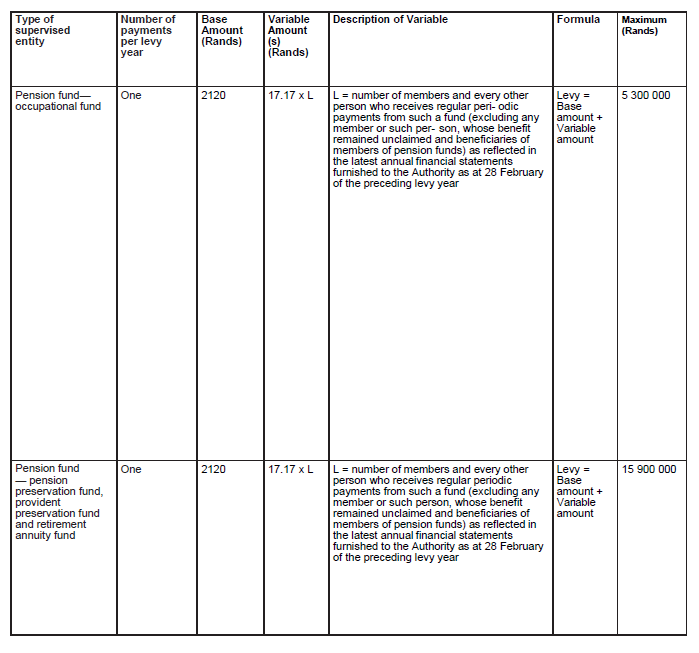

a pension fund: occupational fund; |

| (p) |

a pension fund: preservation fund; |

| (q) |

a pension fund: provident preservation fund; |

| (r) |

a pension fund: retirement annuity fund; |

| (s) |

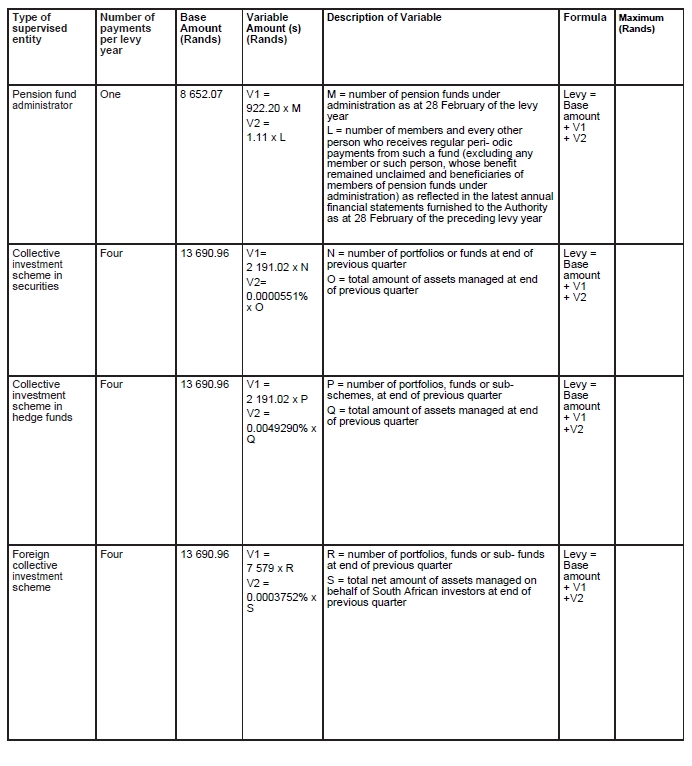

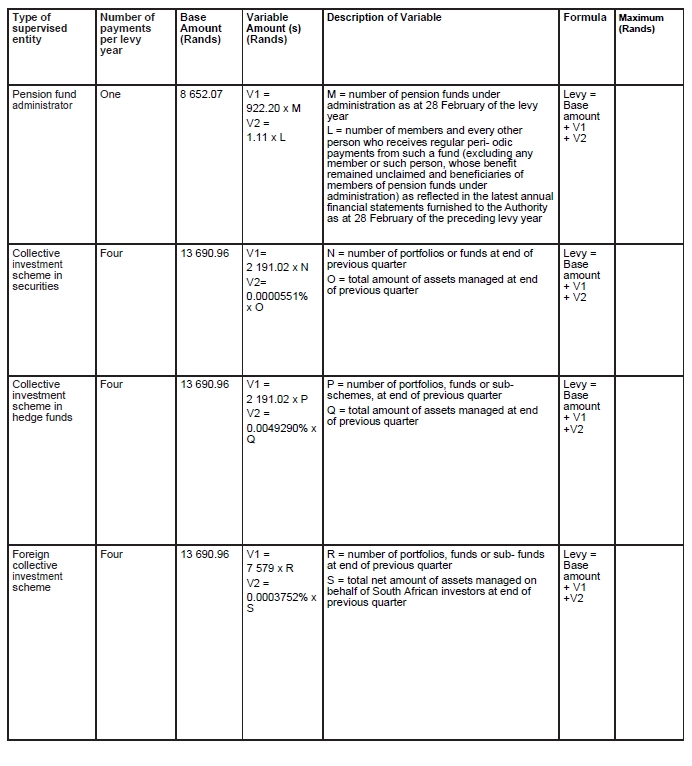

a pension fund administrator; |

| (t) |

a collective investment scheme in securities; |

| (u) |

a collective investment scheme in hedge funds; |

| (v) |

a foreign collective investment scheme; |

| (w) |

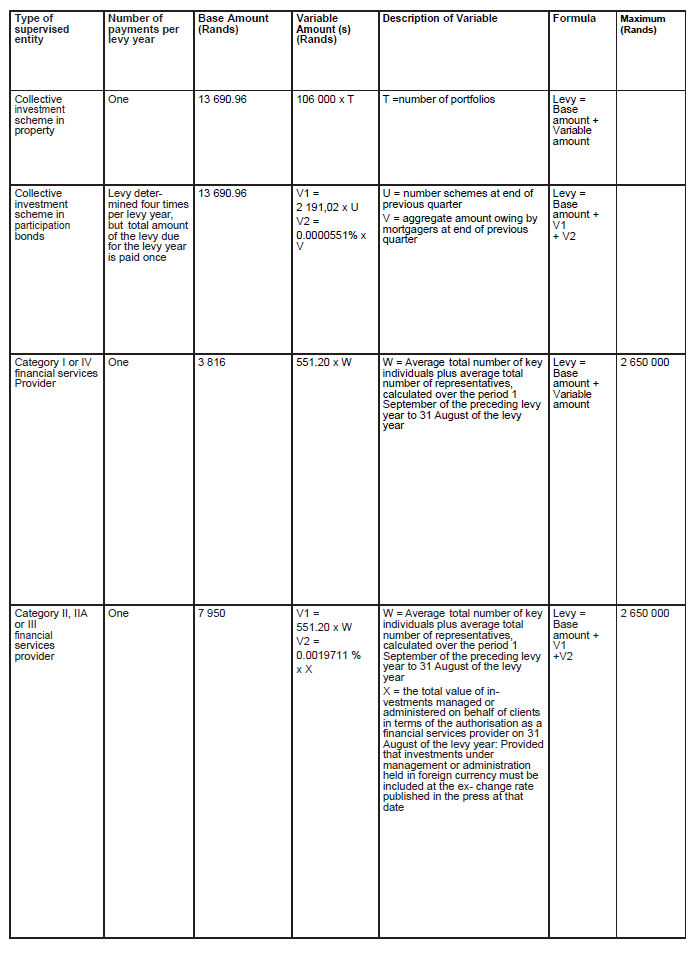

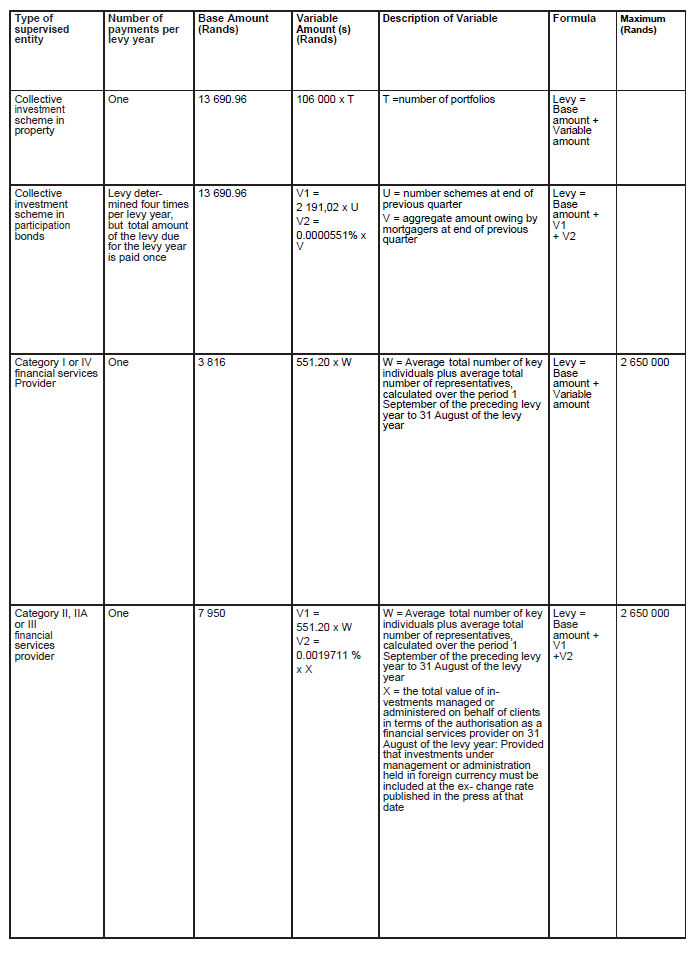

a collective investment scheme in property; |

| (x) |

a collective investment scheme in participation bonds; |

| (y) |

a category I or IV financial services provider; |

| (z) |

a category II, IIA or III financial services provider; |

| (zA) |

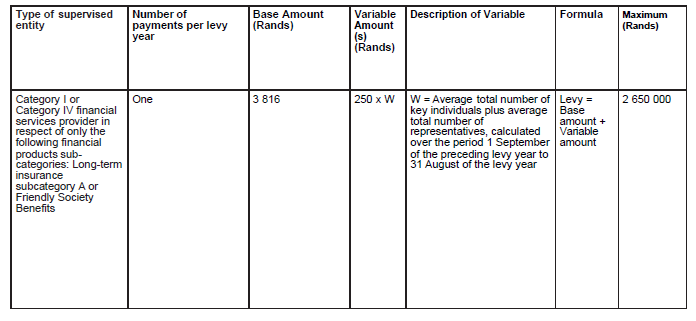

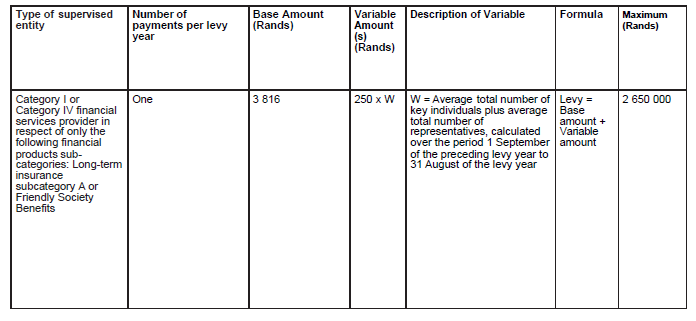

a category I or category IV financial services provider in respect of only the following financial products subcategories: |

| (i) |

Long-term insurance subcategory A; or |

| (ii) |

friendly society benefits; or |

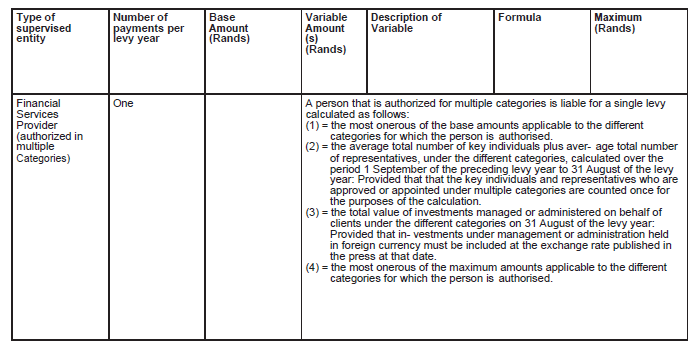

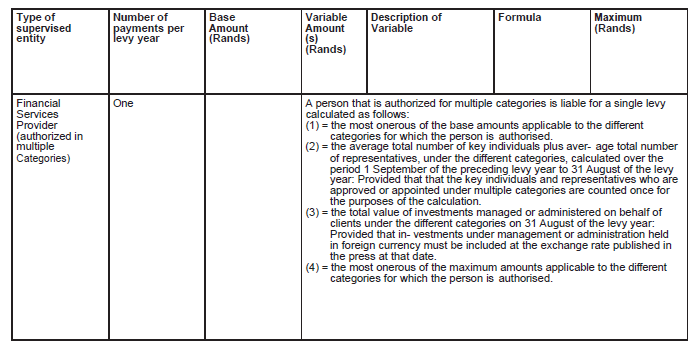

| (zB) |

a financial services provider (authorised in multiple categories). |

Alleviation of double levy payment in respect of clearing house

| 2. |

A clearing house that is approved in terms of section 110(6) of the Financial Markets Act to perform the functions of a central counterparty or a licensed independent clearing house who is also licensed as a central counterparty is liable to pay the levy applicable to a central counterparty, but is not liable to pay the levy applicable to an associated clearing house or an independent clearing house. |

Levy payment in respect of reinsurer

| 3. |

A reinsurer that is licensed under the Insurance Act to conduct both life insurance business and non-life insurance business must be levied separately for its life insurance business and non-life insurance business. |

[Schedule 2 Table B substituted in terms of section 10(1) and (4) of the Act by Notice No. 5151, GG51117, dated 23 August 2024]

Explanatory Note

The financial sector levy payable by supervised entities in respect of the Ombud Council in accordance with Table D of Schedule 4 to the Act increases as a consequence of the amendment to the calculation of the levies payable by supervised entities in terms of Table B of Schedule 2 to the Act.

Sterilisation Act, 1998

Sterilisation Act, 1998