Copyright Act, 1978

Copyright Act, 1978

R 385

Labour Relations Act, 1995 (Act No. 66 of 1995)NoticesBargaining Council for the Building IndustryNorth and West BolandExtension of Collective Agreement to non-parties15. Retirement Funds |

| (1) | The pension fund known as the Building Industry Pension Fund and the provident fund known as the Building Industry Provident Fund ("the Retirement Funds") are hereby continued and shall be continued to be administered by the Council in accordance with the provisions of the Act for the purpose of providing retirement benefits to employees in respect of whom contributions are made in terms of this clause, and the Council shall further be entitled to establish any other like fund or scheme which it deems fit for this purpose. |

| (2) | For the purpose of achieving the objects of this clause the Council shall be entitled to enter into any agreements it deems fit and shall further be entitled to make rules in respect of the operation and administration of any fund established in terms of this clause, which may be amended from time to time. |

| (3) | All employees to whom this Agreement relates, shall in the manner determined by the Council from time to time, elect to join either the Pension Fund or the Provident Fund, and such decisions shall be final. |

| (4) | Contributions by the employer: |

| (a) | Every employer shall contribute an amount to the Retirement Fund on behalf of each eligible employee in respect of each contribution day that the employee remains in his/her employ, which shall be calculated as follows: |

From the date of commencement of this Agreement to 31 October 2024

|

Category of employee |

From the date of commencement of this Agreement to 31 October 2024 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

17,62 |

17,62 |

17,62 |

17,62 |

||

|

|

|

|

|

||

|

17,62 |

17,62 |

17,62 |

17,62 |

||

|

|

|

|

|

||

|

17,62 |

17,62 |

17,62 |

17,62 |

||

|

|

|

|

|

||

|

18,75 |

18,75 |

18,75 |

18,75 |

||

|

20,44 |

20,44 |

20,44 |

20,44 |

||

|

22,47 |

22,47 |

22,47 |

22,47 |

||

|

24,73 |

24,73 |

24,73 |

24,73 |

||

|

27,20 |

27,20 |

27,20 |

27,20 |

||

|

29,92 |

29,92 |

29,92 |

29,92 |

||

|

32,92 |

32,92 |

32,92 |

32,92 |

||

|

36,21 |

36,21 |

36,21 |

36,21 |

||

|

39,82 |

39,82 |

39,82 |

39,82 |

||

|

43,81 |

43,81 |

43,81 |

43,81 |

||

|

48,19 |

48,19 |

48,19 |

48,19 |

||

|

53,01 |

53,01 |

53,01 |

53,01 |

||

|

58,31 |

58,31 |

58,31 |

58,31 |

||

|

64,13 |

64,13 |

64,13 |

64,13 |

||

|

17,62 |

17,62 |

17,62 |

17,62 |

||

|

20,44 |

20,44 |

20,44 |

20,44 |

||

|

22,47 |

22,47 |

22,47 |

22,47 |

||

|

24,73 |

24,73 |

24,73 |

24,73 |

||

|

29,92 |

29,92 |

29,92 |

29,92 |

||

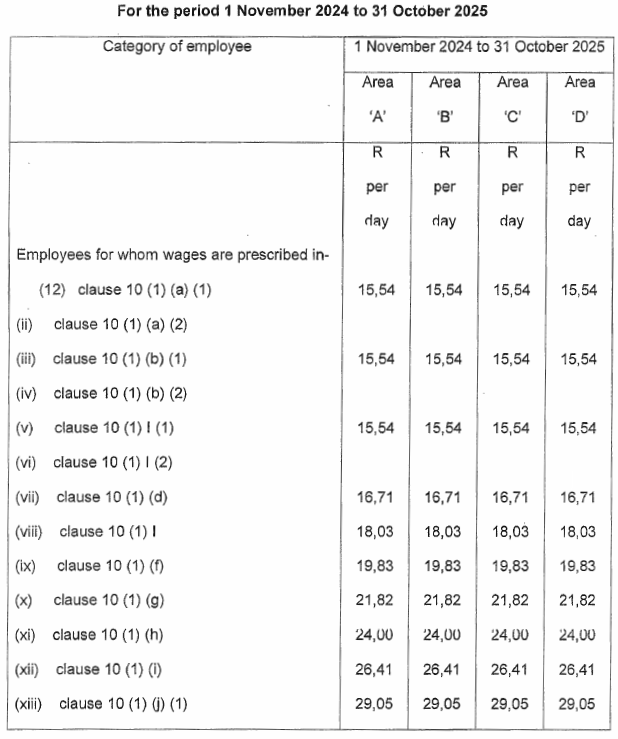

For the period 1 November 2024 to 31 October 2025

|

Category of employee |

1 November 2024 to 31 October 2025 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

15,54 |

15,54 |

15,54 |

15,54 |

||

|

|

|

|

|

||

|

15,54 |

15,54 |

15,54 |

15,54 |

||

|

|

|

|

|

||

|

15,54 |

15,54 |

15,54 |

15,54 |

||

|

|

|

|

|

||

|

16,71 |

16,71 |

16,71 |

16,71 |

||

|

18,03 |

18,03 |

18,03 |

18,03 |

||

|

19,83 |

19,83 |

19,83 |

19,83 |

||

|

21,82 |

21,82 |

21,82 |

21,82 |

||

|

24,00 |

24,00 |

24,00 |

24,00 |

||

|

26,41 |

26,41 |

26,41 |

26,41 |

||

|

29,05 |

29,05 |

29,05 |

29,05 |

||

|

31,95 |

31,95 |

31,95 |

31,95 |

||

|

35,14 |

35,14 |

35,14 |

35,14 |

||

|

38,66 |

38,66 |

38,66 |

38,66 |

||

|

42,52 |

42,52 |

42,52 |

42,52 |

||

|

46,78 |

46,78 |

46,78 |

46,78 |

||

|

51,45 |

51,45 |

51,45 |

51,45 |

||

|

56,59 |

56,59 |

56,59 |

56,59 |

||

|

15,54 |

15,54 |

15,54 |

15,54 |

||

|

18,03 |

18,03 |

18,03 |

18,03 |

||

|

19,83 |

19,83 |

19,83 |

19,83 |

||

|

21,82 |

21,82 |

21,82 |

21,82 |

||

|

26,41 |

26,41 |

26,41 |

26,41 |

||

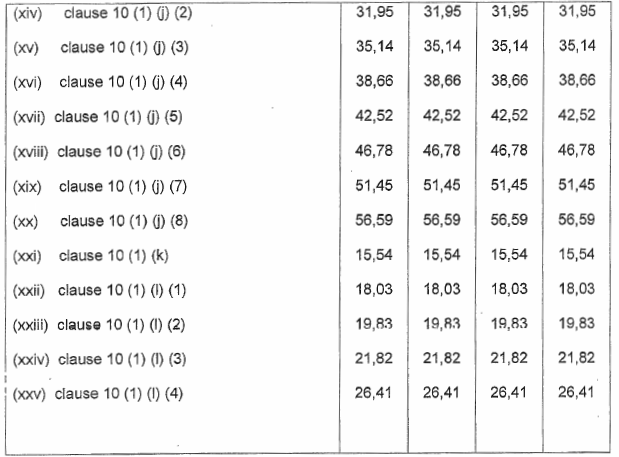

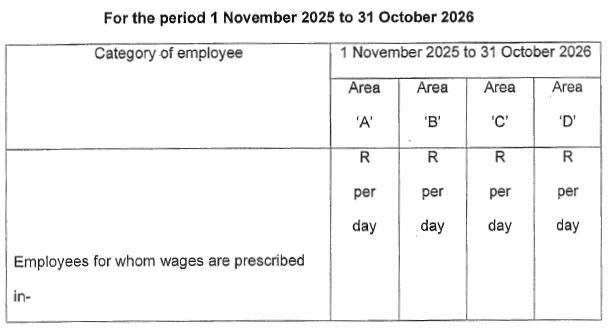

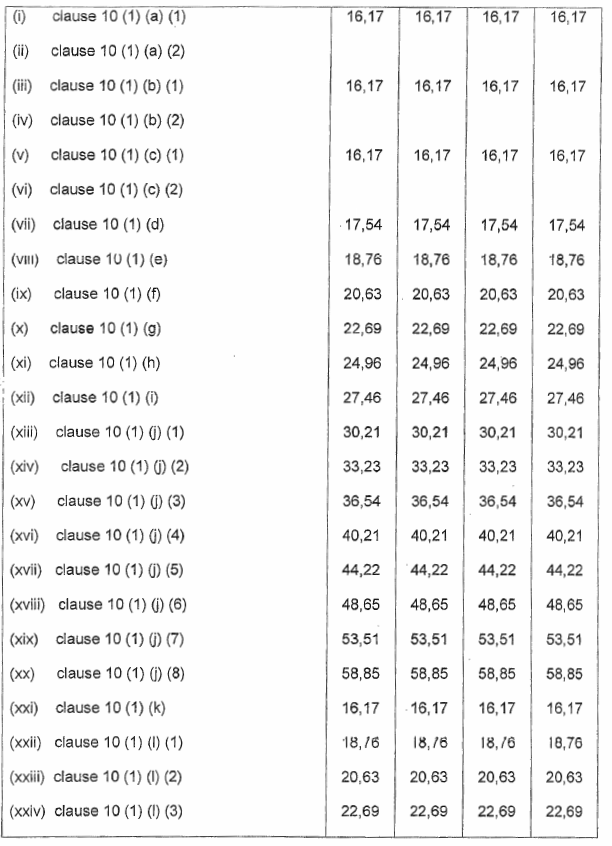

For the period 1 November 2025 to 31 October 2026

|

Category of employee |

1 November 2025 to 31 October 2026 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

16,17 |

16,17 |

16,17 |

16,17 |

||

|

|

|

|

|

||

|

16,17 |

16,17 |

16,17 |

16,17 |

||

|

|

|

|

|

||

|

16,17 |

16,17 |

16,17 |

16,17 |

||

|

|

|

|

|

||

|

17,54 |

17,54 |

17,54 |

17,54 |

||

|

18,76 |

18,76 |

18,76 |

18,76 |

||

|

20,63 |

20,63 |

20,63 |

20,63 |

||

|

22,69 |

22,69 |

22,69 |

22,69 |

||

|

24,96 |

24,96 |

24,96 |

24,96 |

||

|

27,46 |

27,46 |

27,46 |

27,46 |

||

|

30,21 |

30,21 |

30,21 |

30,21 |

||

|

33,23 |

33,23 |

33,23 |

33,23 |

||

|

36,54 |

36,54 |

36,54 |

36,54 |

||

|

40,21 |

40,21 |

40,21 |

40,21 |

||

|

44,22 |

44,22 |

44,22 |

44,22 |

||

|

48,65 |

48,65 |

48,65 |

48,65 |

||

|

53,51 |

53,51 |

53,51 |

53,51 |

||

|

58,85 |

58,85 |

58,85 |

58,85 |

||

|

16,17 |

16,17 |

16,17 |

16,17 |

||

|

18,76 |

18,76 |

18,76 |

18,76 |

||

|

20,63 |

20,63 |

20,63 |

20,63 |

||

|

22,69 |

22,69 |

22,69 |

22,69 |

||

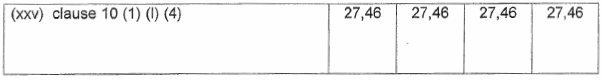

|

27,46 |

27,46 |

27,46 |

27,46 |

||

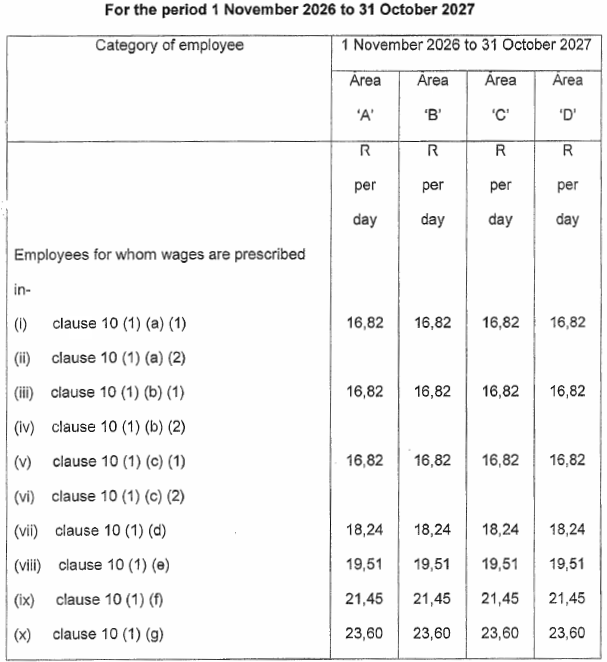

For the period 1 November 2026 to 31 October 2027

|

Category of employee |

1 November 2026 to 31 October 2027 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

16,82 |

16,82 |

16,82 |

16,82 |

||

|

|

|

|

|

||

|

16,82 |

16,82 |

16,82 |

16,82 |

||

|

|

|

|

|

||

|

16,82 |

16,82 |

16,82 |

16,82 |

||

|

|

|

|

|

||

|

18,24 |

18,24 |

18,24 |

18,24 |

||

|

19,51 |

19,51 |

19,51 |

19,51 |

||

|

21,45 |

21,45 |

21,45 |

21,45 |

||

|

23,60 |

23,60 |

23,60 |

23,60 |

||

|

25,96 |

25,96 |

25,96 |

25,96 |

||

|

28,56 |

28,56 |

28,56 |

28,56 |

||

|

31,42 |

31,42 |

31,42 |

31,42 |

||

|

34,56 |

34,56 |

34,56 |

34,56 |

||

|

38,01 |

38,01 |

38,01 |

38,01 |

||

|

41,82 |

41,82 |

41,82 |

41,82 |

||

|

45,99 |

45,99 |

45,99 |

45,99 |

||

|

50,59 |

50,59 |

50,59 |

50,59 |

||

|

55,65 |

55,65 |

55,65 |

55,65 |

||

|

61,21 |

61,21 |

61,21 |

61,21 |

||

|

16,81 |

16,81 |

16,81 |

16,81 |

||

|

19,51 |

19,51 |

19,51 |

19,51 |

||

|

21,45 |

21,45 |

21,45 |

21,45 |

||

|

23,60 |

23,60 |

23,60 |

23,60 |

||

|

28,56 |

28,56 |

28,56 |

28,56 |

||

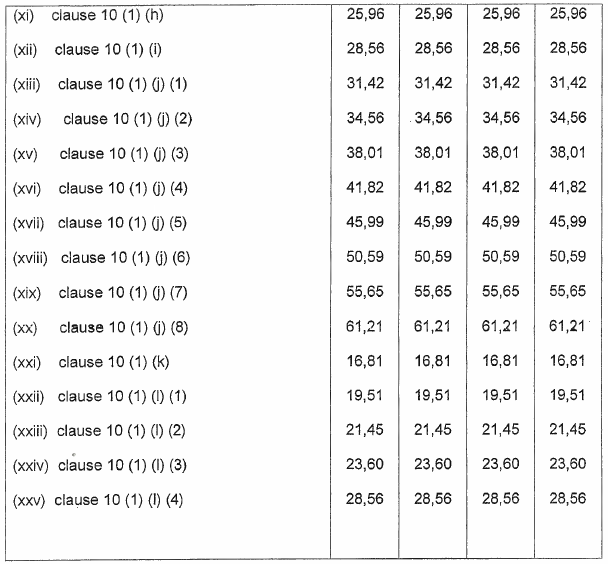

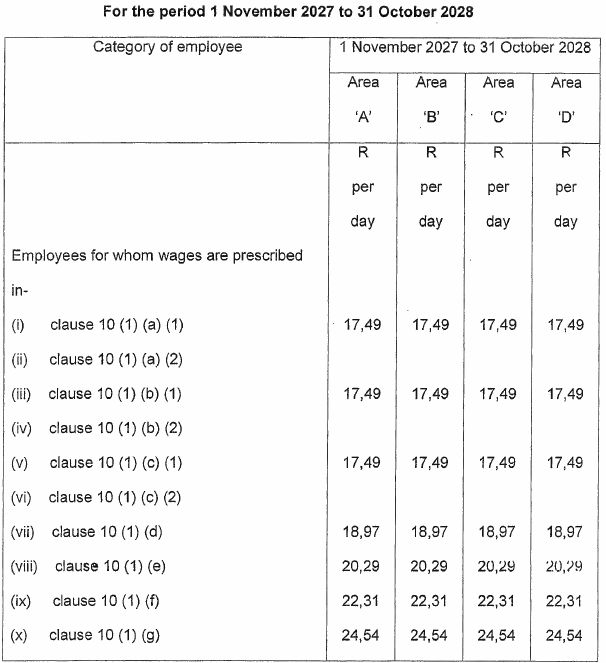

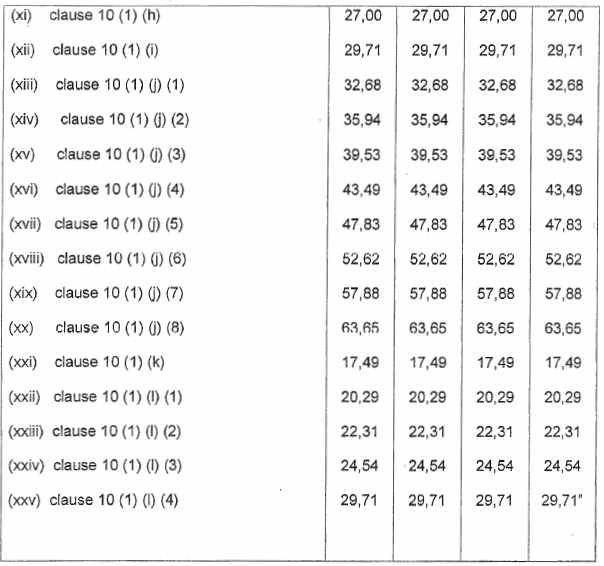

For the period 1 November 2027 to 31 October 2028

|

Category of employee |

From the date of commencement of this Agreement to 31 October 2024 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

17,49 |

17,49 |

17,49 |

17,49 |

||

|

|

|

|

|

||

|

17,49 |

17,49 |

17,49 |

17,49 |

||

|

|

|

|

|

||

|

17,49 |

17,49 |

17,49 |

17,49 |

||

|

|

|

|

|

||

|

18,97 |

18,97 |

18,97 |

18,97 |

||

|

20,29 |

20,29 |

20,29 |

20,29 |

||

|

22,31 |

22,31 |

22,31 |

22,31 |

||

|

24,54 |

24,54 |

24,54 |

24,54 |

||

|

27,00 |

27,00 |

27,00 |

27,00 |

||

|

29,71 |

29,71 |

29,71 |

29,71 |

||

|

32,68 |

32,68 |

32,68 |

32,68 |

||

|

35,94 |

35,94 |

35,94 |

35,94 |

||

|

39,53 |

39,53 |

39,53 |

39,53 |

||

|

43,49 |

43,49 |

43,49 |

43,49 |

||

|

47,83 |

47,83 |

47,83 |

47,83 |

||

|

52,62 |

52,62 |

52,62 |

52,62 |

||

|

57,88 |

57,88 |

57,88 |

57,88 |

||

|

63,65 |

63,65 |

63,65 |

63,65 |

||

|

17,49 |

17,49 |

17,49 |

17,49 |

||

|

20,29 |

20,29 |

20,29 |

20,29 |

||

|

22,31 |

22,31 |

22,31 |

22,31 |

||

|

24,54 |

24,54 |

24,54 |

24,54 |

||

|

29,71 |

29,71 |

29,71 |

29,71 |

||

[Clause 15(4)(a) substituted by section 6(6.1) of Notice No. R. 4190, GG49862, dated 14 December 2023]

| (b) | Every employer shall pay the specified contribution to the Council on the employee's normal pay day, and shall on that day endorse and issue the employee with the Council's fringe benefits indicating the amount of the contribution made. |

[Clause 15(4)(b) substituted by section 6(6.1) of Notice No. R. 4190, GG49862, dated 14 December 2023]

| (c) | If an employee fails to qualify for death, disability and/or funeral benefits in terms of the Pension or Provident Fund because an employer has neglected or failed to pay contributions owing to him/her in respect of the employee's membership, such employer shall be liable to pay such employee or his/her beneficiary an amount of money equal to the death, disability and/or funeral benefits that would have been payable to the employee under the rules of the applicable fund had the contributions been paid by the employer. |

| (5) | Subject to an eligible employee's right to nominate a beneficiary to receive any amounts which may become due to him in terms of the Retirement Funds in the event of his death before retirement, any pension/provident benefits accruing to an employee in terms of this Agreement shall not be transferable, and may not be ceded or pledged. |

| (6) | In the event of the Council's being dissolved, wound up or ceasing to operate during the currency of this Agreement, the parties shall appoint a trustee or trustees before such dissolution or winding up to perform the functions set out in this clause, which trustee or trustees shall have all the powers vested in the Council for this purpose. |

| (7) | Contributions by employees: |

| (a) | Every employer shall deduct a retirement fund contribution amount on behalf of each eligible employee in respect of each day that the employee remains in his I her employ, which shall be calculated as follows: |

From the date of commencement of this Agreement to 31 October 2024

|

Category of employee |

From the date of commencement of this Agreement to 31 October 2024 |

|||||

|

Area "A" |

Area "B" |

Area "C" |

Area "D" |

|||

|

R per day |

R per day |

R per day |

R per day |

|||

|

Employees for whom wages are prescribed in— |

|

|

|

|

||

|

12,28 |

12,28 |

12,28 |

12,28 |

||

|

|

|

|

|

||

|

12,28 |

12,28 |

12,28 |

12,28 |

||

|

|

|

|

|

||

|

12,28 |

12,28 |

12,28 |

12,28 |

||

|

|

|

|

|

||

|

13,07 |

13,07 |

13,07 |

13,07 |

||

|

14,25 |

14,25 |

14,25 |

14,25 |

||

|

15,66 |

15,66 |

15,66 |

15,66 |

||

|

17,23 |

17,23 |

17,23 |

17,23 |

||

|

18,96 |

18,96 |

18,96 |

18,96 |

||

|

20,86 |

20,86 |

20,86 |

20,86 |

||

|

22,94 |

22,94 |

22,94 |

22,94 |

||

|

25,24 |

25,24 |

25,24 |

25,24 |

||

|

27,75 |

27,75 |

27,75 |

27,75 |

||

|

30,54 |

30,54 |

30,54 |

30,54 |

||

|

33,59 |

33,59 |

33,59 |

33,59 |

||

|

36,95 |

36,95 |

36,95 |

36,95 |

||

|

40,64 |

40,64 |

40,64 |

40,64 |

||

|

44,70 |

44,70 |

44,70 |

44,70 |

||

|

12,28 |

12,28 |

12,28 |

12,28 |

||

|

14,25 |

14,25 |

14,25 |

14,25 |

||

|

15,66 |

15,66 |

15,66 |

15,66 |

||

|

17,23 |

17,23 |

17,23 |

17,23 |

||

|

20,86 |

20,86 |

20,86 |

20,86 |

||

[Clause 15(7) substituted by section 6(6.2) of Notice No. R. 4190, GG49862, dated 14 December 2023]